In a recent turn of events, the political landscape in the United States has seen significant figures such as President Donald Trump and Treasury Secretary Scott Bessent advocate vigorously for reductions in interest rates, setting a favourable scene for the price of gold as it hovers near a critical tipping point. Their outright support for aggressive monetary easing by the Federal Reserve signals a notable shift towards more expansive fiscal and monetary policies.

Gold’s Prospect Amidst Calls for Rate Cuts

In an era where the President and the Treasury Secretary are both championing for substantial cuts in the interest rates – advocating for reductions that span several hundred basis points – amidst a governmental backdrop marked by a near $300 billion monthly deficit, a stable unemployment rate at 4.2%, and persistently high inflation rates, the allure of finite resources like gold intensifies. The current economic milieu, characterized by an imminent inclination towards easing interest rates at the shorter end of the yield curve as evidenced by long bond market dynamics, consequently bolsters the appeal of investing in gold.

Gold finds itself at a critical juncture, tracing the contours of a symmetrical triangle pattern, indicating a build-up of momentum for a potential bullish breakout. This setup, especially in the light of a likely collision between hyper-expansive fiscal stances and ultra-loose monetary environments, insists on heightened vigilance from traders for an explosive upward movement in gold prices.

Pressure on the Federal Reserve

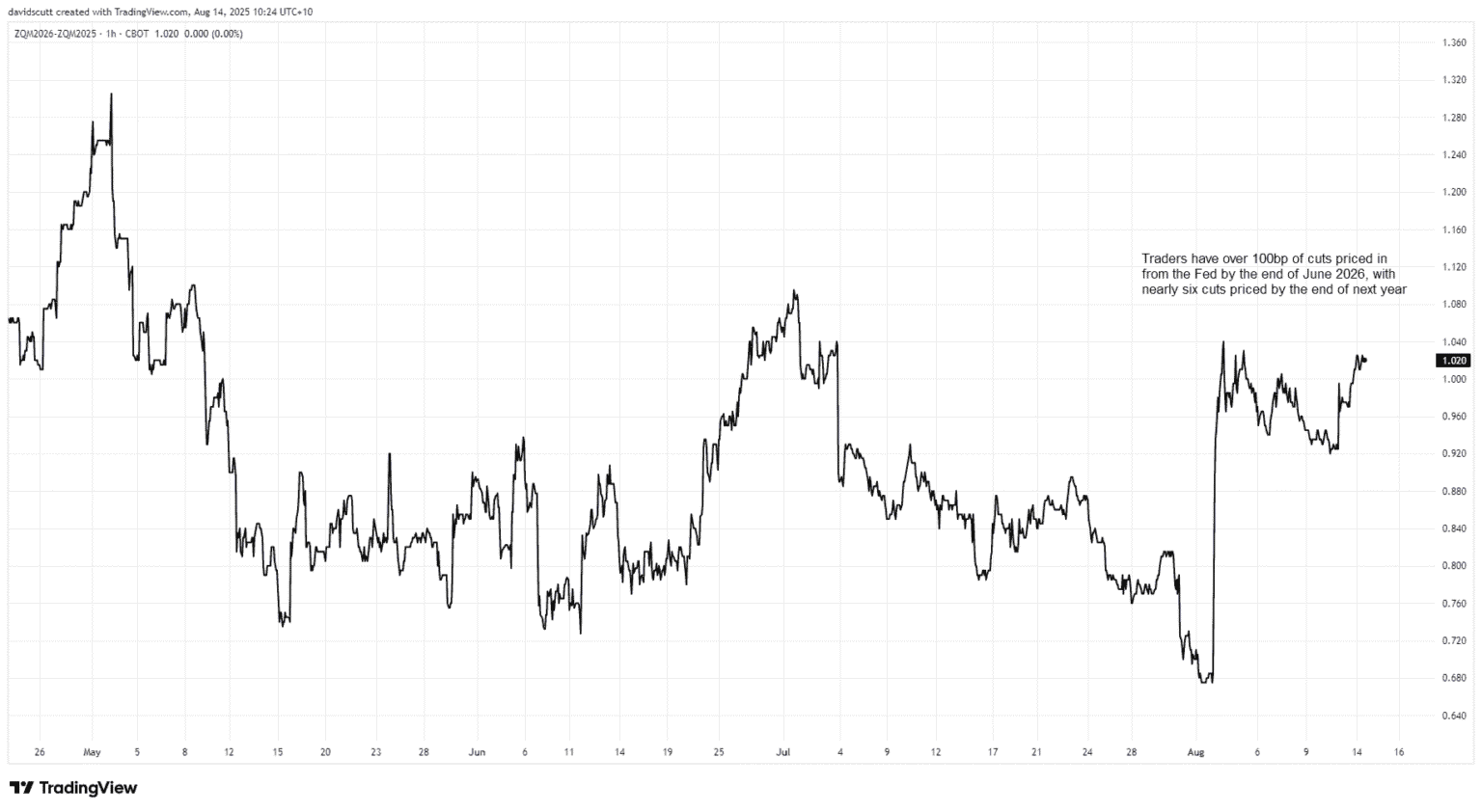

Over the recent weeks, President Trump and Treasury Secretary Scott Bessent have intensified their pressure on the Federal Reserve, advocating for robust rate cuts. Trump has voiced his opinion that interest rates should be drastically lower by three to four hundred basis points, hinting at a possible replacement for Jerome Powell as the Fed Chair before his current term concludes. Bessent, on his part, has called for immediate rate cuts ranging from 150 to 175 basis points, supported by amended labour market data suggesting the justifications for such a move.

This strategic maneuver for a ‘shadow Fed’ emerges as criticism mounts over Powell’s decision to maintain steady rates, with warnings about the adverse impacts of high borrowing costs on businesses, consumers, and prospective homeowners. Despite Bessent’s perspective aligning with prevailing market sentiments, his dovish stance notably shifts rate expectations and demonstrates the current administration’s endeavours to appoint individuals in line with its expansive economic agenda.

Market Response and the Dovish Shift

Currently, financial markets seem to have embraced the dovish pivot, with both short and long-term Treasury yields retracting from their previous highs amidst a bull steepening of curves – a phenomenon typical at the onset of reflationary cycles. Despite inflation expectations breaching target levels, they remain within the bounds of past two-year performances.

In an atmosphere marked by unprecedented calmness, where equity and bond market volatilities have plummeted to significant lows, the dollar has softened. This tranquility, coupled with the anticipation of impending rate cuts, crafts an optimal environment for precious metals like gold to thrive. This situation is even more pronounced when contemplating the potential surge in inflationary pressures or market volatilities, scenarios that are currently undervalued in the context of heavily leveraged risk assets.

Technically, the pathway for gold prices seems inclined towards an upward trajectory, buoyed by fundamental and technical analysis alike. The symmetrical triangle pattern it currently traces suggests a brewing momentum for a bullish breakout, particularly as gold repeatedly tests its downtrend resistance with sporadic false breaks.

In conclusion, as gold teeters on the brink of a significant breakout against the backdrop of a dovish shift in monetary policy and a supportive fiscal environment, the stage is set for a pivotal moment in its market trajectory. The intersection of political influence, economic policies, and market dynamics underscores the intricate relationship between geopolitical developments and financial markets, reinforcing the crucial role of vigilance and strategic foresight in navigating the complex world of commodity investments.