As the world finds itself enmeshed in yet another chapter of escalating trade tensions, the spotlight once again falls on the illustrious gold market, long regarded as the barometer of economic uncertainty. The recent weeks have seen a riveting dance around the $3400 per ounce mark, a psychological milestone for gold enthusiasts and investors alike. Yet, the sustainability of this breach remains a question that looms large, especially in light of renewed trade friction.

In the intricate ballet of global finance, gold had briefly pirouetted above the $3400 threshold, only to retreat in the face of a market sell-off, closing the European session at approximately $3384 per ounce. This delicate fluctuation mirrors the broader narrative of economic resilience and vulnerability, encapsulated by the ongoing saga of US-EU trade relationships.

A Tale of Trade and Tension

At the heart of the matter are the escalating trade tensions between the United States and the European Union, a saga that has unfolded with all the twists and turn of a geopolitical thriller. The narrative took a dramatic turn with reports from the Wall Street Journal detailing an increase in the baseline tariff rate proposed by President Trump, from 10% to a heftier 15-20%. This development threw a wrench in the European Union’s calculations, prompting a stalwart response from its member states.

Germany, alongside France and a coalition of European nations, has publicly hardened its stance against the US administration’s proposals. A German official’s bold declaration, “If they want war, they will get war,” encapsulates the sheer determination and readiness for a standoff, should diplomatic efforts falter before the crucial August deadline.

Amidst this backdrop of brewing conflict and the ticking clock towards a potential trade deadlock, gold finds itself in a pivotal position. The precious metal, historically a haven in times of turmoil, could well see its fortunes rise should the current tensions escalate further without resolution, potentially securing its position above the much-coveted $3400 mark.

The Dollar’s Dance

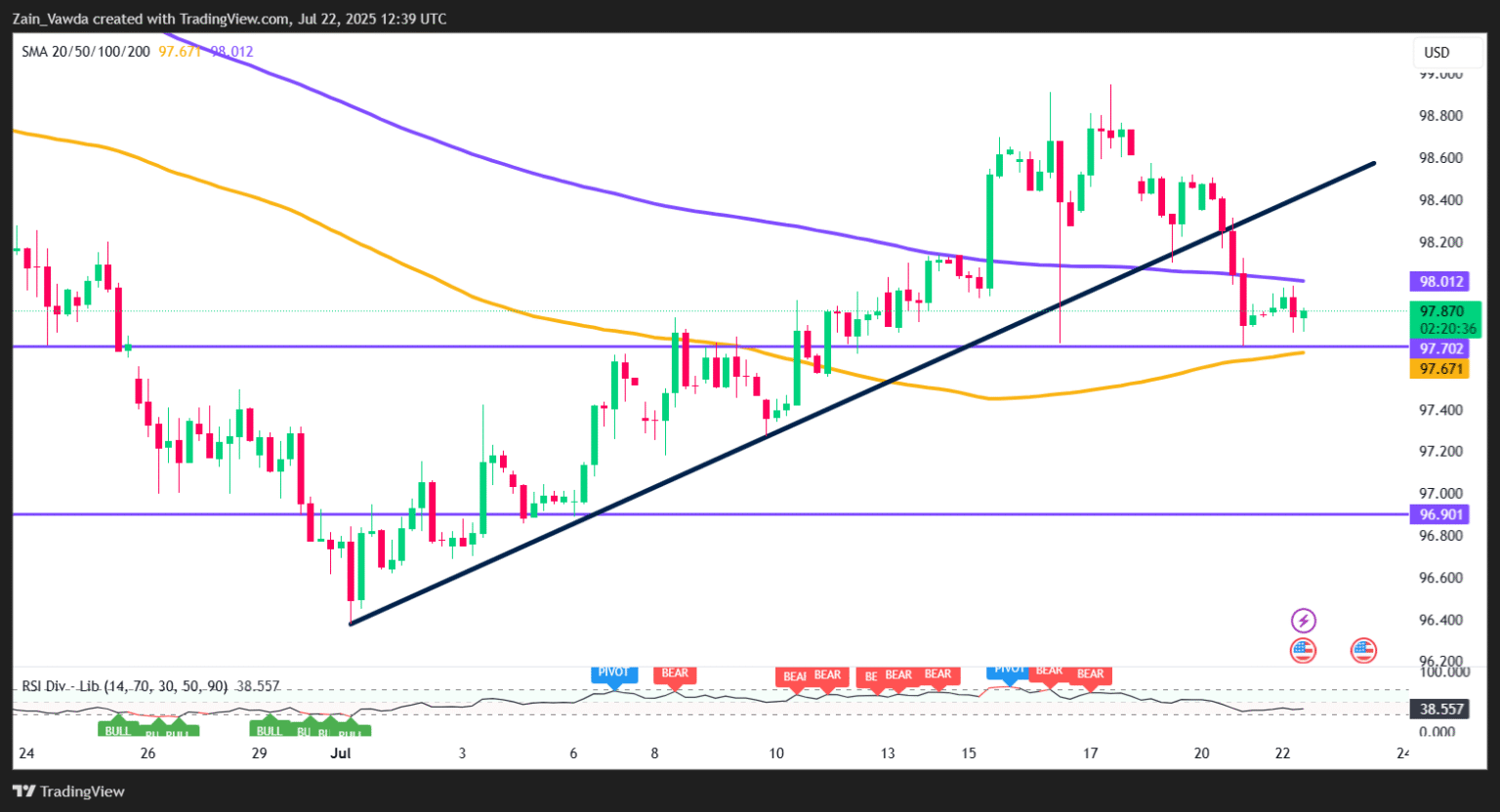

Adding another layer to this complex interplay is the trajectory of the US Dollar, particularly as evidenced by the performance of the US Dollar Index (DXY). Andrew Bailey, the President of the Bank of England, has highlighted the crowded nature of dollar short trades, underscoring the prevailing market sentiment.

A technical examination of the DXY reveals it teetering on the brink, finding precarious support at the 100-day Moving Average (MA) of 97.67. A breach below this floor could spell further depreciation, with the next lines of defense pegged at 97.26 and 96.90, respectively. Conversely, a resurgence above the 200-day MA could signify a bullish reversal for the dollar, a scenario hinted at by the Relative Strength Index (RSI) bouncing off a neutral stance.

Greater Implications for the Week Ahead

With scant data emerging from the US to steer the markets, attention will inevitably pivot towards trade negotiations and corporate earnings as primary catalysts. Upcoming US housing data and S&P information will likely offer deeper insights into the economic landscape, potentially influencing the dollar and, by extension, gold prices.

Navigating the Golden Currents

From a technical perspective, gold stands at a crossroads. Having flirted with the $3400 threshold, its trajectory hinges on a definitive break, a daily close above this level serving as a harbinger for potential uptrend continuation. The metal has charted a path marked by higher highs since its nadir on June 30, navigating within a discernible triangle pattern. A conclusive breakout towards the upper band of this pattern could set the stage for a rally towards the $3800 vicinity, while failure to breach may see a retracement towards immediate supports.

Sentiment in the Balance

Market sentiment, as captured by OANDA’s client data, evinces a split verdict with a slight leaning towards bullish positions, a testament to the prevailing uncertainty and divided opinion among investors regarding gold’s immediate future.

In summary, the confluence of heightened trade tensions, dollar dynamics, and technical indicators paints a complex picture for gold in the days ahead. As historical patterns and current geopolitics intertwine, the only certainty is the enduring allure of gold as a sanctuary amidst the storm. The unfolding saga of US-EU relations, coupled with the dollar’s dance on the technical tightrope, will be instrumental in charting the course for this ancient store of value. Whether gold can sustain its ascent above the $3400 watershed remains a narrative in progress, reflective of the broader economic and geopolitical currents shaping our world.