In the swelter of a charged Democratic National Convention in 1896, an impassioned plea echoed through the hall, leaving an indelible mark on American politics and the monetary policy debates of the era. “You shall not crucify mankind upon a cross of gold,” proclaimed William Jennings Bryan, setting the stage for a fierce ideological battle over the future direction of America’s economy.

Bryan, who had been chosen as the Democratic Party’s standard-bearer for the presidency, was an avowed critic of the prevailing gold standard. Instead, he championed the greater incorporation of silver into the nation’s monetary system, arguing that this would create a more equitable and prosperous society.

The latter half of the 19th century was rife with economic tumult and political movements, particularly within the Democratic Party, advocating for inflationary measures to ease the financial burdens on the populace. Adhering to the gold standard constrained governmental power to redistribute wealth by inflating the currency. The concept of paper money not backed by a physical commodity was untenable at the time. Consequently, proponents of inflation, including various factions within the Democrats, rallied around silver as the most accessible alternative to gold.

Farmers, for instance, sought inflationary policies to repay their debts with devalued currency, thereby easing their financial strain. In a bid to address these demands, Congress enacted the Sherman Silver Purchase Act, compelling the U.S. government to procure significant amounts of silver. This was hoped to bolster its value and instigate the desired inflation. Bryan’s electrifying condemnation of the gold standard must be viewed within this tumultuous backdrop of financial policy debate.

Nevertheless, the push for silver as a means to facilitate inflation ultimately did not succeed. Bryan’s bid for the presidency fell short, and the nation did not pivot towards silver, marking a temporary triumph for advocates of a more rigid monetary system. Yet, this victory was to be short-lived as the ensuing decades saw the U.S. transition towards an even more flexible currency model – the unfettered fiat paper money, devoid of the backing of any precious metal.

This historical narrative serves two pivotal ends. Firstly, it exemplifies the natural tension between hard money – which places inherent limits on governmental fiscal extravagance – and the desires of those in power to engage in such profligacy for various reasons, a tension that has wide-ranging implications for economic policy and governance. Secondly, and of profound significance, the defeat of silver in favour of gold underscores a fundamental economic principle that remains critical for comprehending the broader financial landscape and leveraging such understanding for significant investment gains.

The Demise of Silver’s Monetary Role and its Contemporary Relevance

Traditionally, gold has been the preferred standard for monetary security due to its scarcity and inherent value. However, silver once played a crucial role in day-to-day transactions thanks to its more practicable denomination for minor exchanges. This earned silver the moniker “gentleman’s money,” while gold was revered as “the money of kings” owing to its higher value density.

As the 19th century waned, advancements in the banking sector reduced the necessity for physical silver coins. Banks began to issue paper notes guaranteed by gold reserves, making gold a more viable option for even small transactions. This shift demonstrated the public’s preference for a ‘harder’ form of money, even at the cost of relying on financial institutions as intermediaries.

Consequently, silver’s prominence in the monetary system waned, relegating it to a predominantly industrial material, albeit with a vestigial monetary importance. This dynamic persists today, with silver’s monetary role vastly diminished.

The Singular Rationale Behind Silver Investment

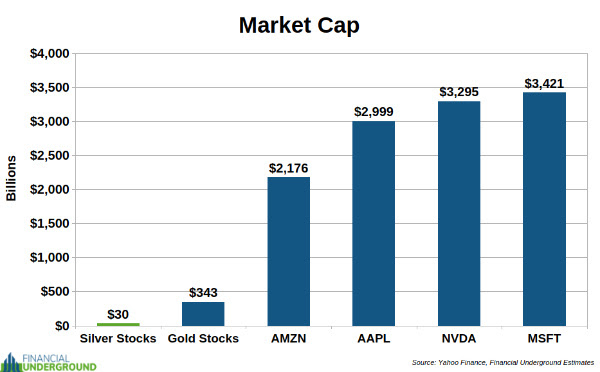

The crux of interest in silver investment lies not in its historical role as a currency or its industrial uses but in its potential for substantial appreciation during periods of monetary instability and high inflation. Silver’s market is relatively small, magnifying its susceptibility to rapid valuation shifts driven by surges in demand during economic crises.

This was dramatically illustrated by the Hunt brothers in the 1970s, who attempted to corner the silver market, resulting in a staggering price surge. Today, as global economic indicators suggest impending inflationary pressures, silver’s appeal as a hedge against currency devaluation becomes increasingly pronounced.

Speculatively, should conditions akin to those of the 1970s or early 1980s re-emerge, silver could experience a similar, if not more pronounced, escalation in value. Adjusted for inflation, the historical peak price of silver suggests a potential for significant returns on silver investments, particularly in an era marked by widespread monetary expansion and fiscal uncertainty.

In Conclusion

The prospects for a significant upturn in silver prices are uniquely aligned with current economic conditions, offering a compelling opportunity for strategic investment. As history and economic principles suggest, silver’s potential in times of monetary upheaval should not be underestimated. This could be the opportune moment to position oneself for what might well be a historic ascent in the value of silver.