The dynamics of the white metals market have undergone a notable transformation, setting off on an ascendant trend beginning early April. This surge can be traced back to a significant announcement by former U.S. President Donald Trump, who declared what he termed “Liberation Day” – the initiation of comprehensive tariffs targeting various economies across the globe.

A critical factor propelling this upward trajectory in the market is the depreciation of the U.S. dollar. Historically, a weaker dollar has bolstered demand for metals, a pattern which is evidently repeating itself in this scenario. Despite the formation of new trade agreements with nations such as China, Japan, and the Philippines, the investment community remains on edge due to the capricious ethos of U.S. foreign policy. This atmosphere of unpredictability continues to cast a shadow over the dollar, thereby affecting investor confidence.

Turning our focus to potential investment avenues within this buoyant rally, an in-depth technical examination reveals several opportunities.

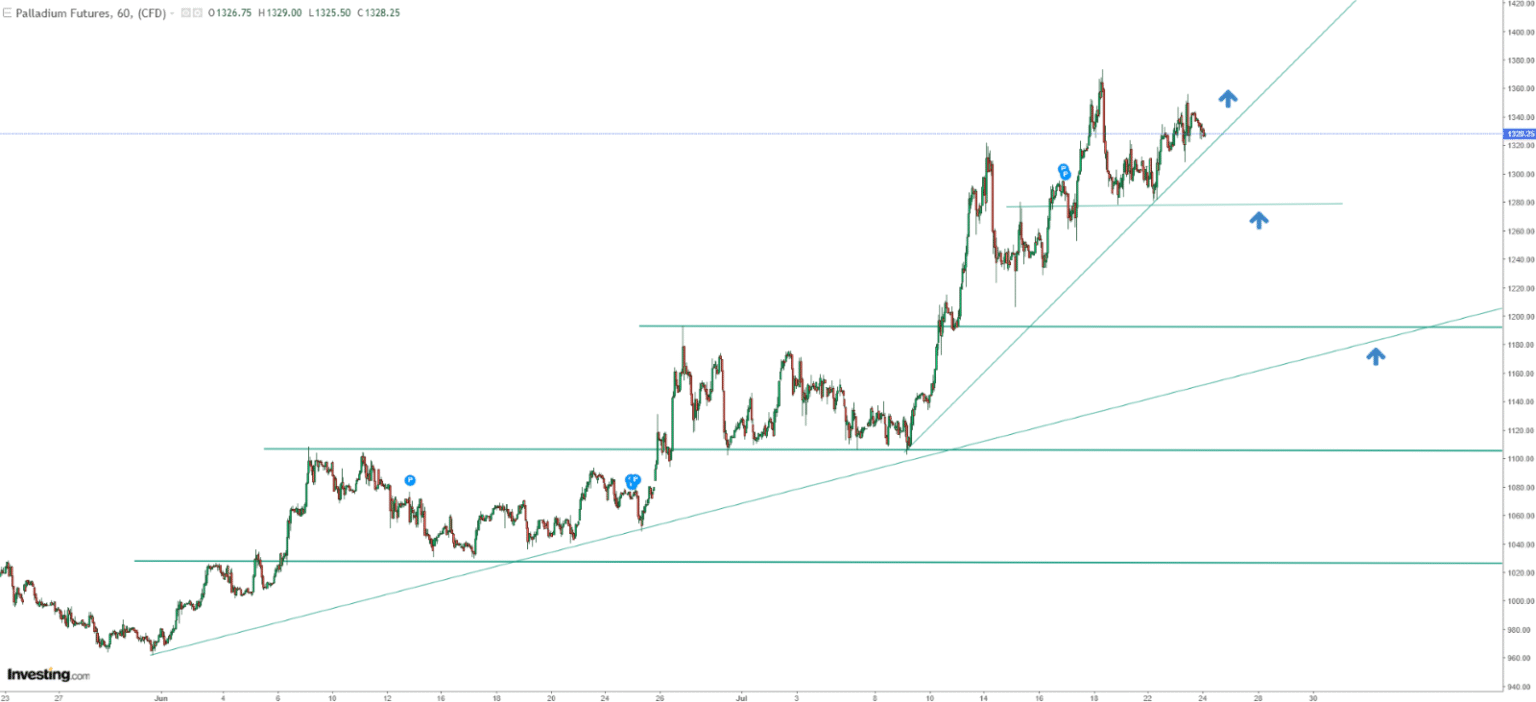

Palladium, for example, has witnessed a substantial upswing in demand throughout the first half of July. This fervent interest has catapulted palladium prices beyond the $1,300 benchmark. The trajectory of this ascent closely adheres to a steep upward trend line. Should this trend line falter, it is plausible to envisage a minor retracement in prices. An initial support is anticipated around the $1,280 level. Should the downtrend persist, the following significant support could be near $1,200, where a robust support zone interconnects with the trend line.

Despite the possibility of a transitory pullback, the broader perspective remains optimistic with sights set on the $1,400 resistance level as the next milestone for buyers.

Silver’s narrative is equally compelling. After recovering from a mid-month dip, silver prices are ascending once more, teetering on the brink of the $40 per ounce threshold. Surpassing this barrier is the current aim for investors, potentially opening discussions about an advance towards the record peak near $50. Given the enduring robust demand that continues to outstrip supply, and with forecasts of demand growth in forthcoming years, such projections appear to be within the realm of possibility.

For those considering entering the market, the support range between $37.70 and $37.50 per ounce merits attention. This zone not only benefits from the reinforcement of the upward trend line but also serves as a critical juncture; its breach could herald a more pronounced retracement.

Platinum’s journey, though encountering the steepest correction amongst the metals reviewed, has arrived at a crucial juncture of support near $1,450. This level is expected to provide a bulwark in the short term. Emerging signs of purchasing activity hint at a potential resurgence, aiming for the immediate resistance at approximately $1,475, where it intersects with the correction trend line. Should selling pressure mount, the decline might extend, targeting a vital support vicinity around the psychological mark of $1,400.

For investors, novice or experienced, navigating these tumultuous waters calls for leveraging sophisticated investment tools like InvestingPro. With the promise of uncovering a myriad of investment prospects while adeptly manoeuvring the complexities of the current market landscape, InvestingPro offers an array of features designed to enhance investment decisions. These include AI-driven stock selections with a stellar performance record, immediate valuation insights to discern under or overpriced stocks, a comprehensive stock screener to identify top-performing stocks based on extensive filters and criteria, and access to investment choices favoured by billionaire investors such as Warren Buffett, Michael Burry, and George Soros.

In the realm of investments, it’s paramount to remember that each venture carries its inherent risks, assessed through multifaceted lenses. Thus, any decision to invest, and the consequent risk entailed, rests solely with the individual investor. It’s also crucial to underscore that this exposition serves purely educational purposes and should not be construed as solicitation, recommendation, or endorsement to invest.