In the financial markets, the shimmer of gold and its corresponding stocks often captures the attention of investors looking for a safe haven or a hedge against market volatility. As we navigate through the latter part of the year, a discernible pattern in the realm of gold trading begins to emerge, characterised by a notable ascendancy in both interest and value. This trend is not merely a fleeting occurrence but is deeply rooted in the annual cycle of demand, particularly accentuated during the autumn months. This period typically heralds a robust phase for gold and, by extension, gold mining stocks, setting the stage for potentially substantial gains.

Understanding the seasonal dynamics of gold trading requires delving into the concept of seasonality itself. Seasonality refers to the patterned, cyclical behaviours in trading prices observed at specific times of the year. This phenomenon does not operate in isolation as a price-driving force. Instead, it provides a framework for understanding how various factors, including sentiment, technical analysis, and fundamental changes, converge in a rhythmic pattern influenced by human behaviour and cultural practices.

The price fluctuations of gold stocks, closely tethered to the movements of gold, magnify this seasonality effect due to their heightened sensitivity to gold’s price changes. Unlike agriculturally-derived commodities, where supply variations primarily drive seasonality, gold’s seasonality is intriguingly demand-driven. Herein lies the essence of its captivating seasonal pattern, which is significantly influenced by cultural and income-cycle factors across the globe.

A closer examination of this pattern reveals its roots in the agricultural cycles of Asia. Post-harvest, typically in the late summer, Asian farmers assess their surplus earnings, often choosing to invest a portion in gold. This cultural practice sets the stage for a domino effect, leading into another pivotal seasonal event—India’s wedding season. The cultural significance of gold in Indian weddings, where parents lavishly adorn their brides with exquisite 22-karat gold jewellery as part of the dowry, creates a surge in demand. This period is considered auspicious for marriages and, consequently, for gold purchases, contributing to a bullish momentum for gold and gold stocks.

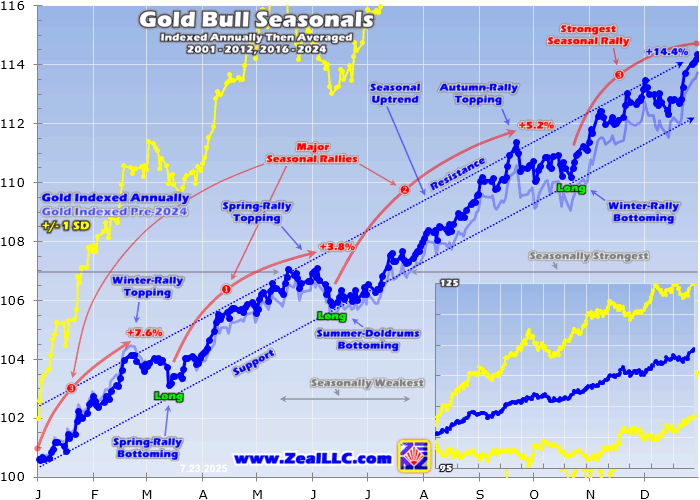

Historically, these consecutive demand surges have catalysed autumn rallies during gold’s bull market phases. Such rallies not only reflect in the rising price of gold but also significantly benefit the gold mining stocks due to their profit leverage to gold prices. Entering the autumn season, this setup presents a bullish horizon, especially given the gradual increase in investor interest observed over the summer months.

The influence of seasonality on gold, underpinned by demand variations, makes a compelling case for its study. Looking at gold’s performance during its bull runs provides insights into potential trends. Between 2001 and 2011, for instance, gold witnessed a remarkable upturn of 640.1%, a period during which gold stocks surged even more dramatically. Such historical bulls are distinguished from bears by their distinct price actions, offering a basis for predicting future movements.

Noteworthy is the resilience of gold amidst fluctuating economic conditions, including inflationary pressures and central bank policies that have historically impacted its price. The gold market’s reaction to global events, such as geopolitical tensions, further underscores the complexity of factors influencing its seasonality.

As we approach the autumn of 2025, the confluence of continued investor interest, particularly from the American market, alongside the traditional surge in Indian demand, hints at a season of remarkable potential for gold and its miners. The anticipation of quarterly results from gold mining companies, expected to reflect record-breaking performances due to prevailing high gold prices, adds another layer of optimism. These reports, likely showcasing unprecedented profits and operational efficiencies, could attract a wider investor base, including institutional investors drawn by the sector’s promising valuation metrics compared to gold.

This stage is set against a backdrop of modern gold bull markets, which have shown significant price variances over the years. The adaptability and resilience of gold as an asset, demonstrated over decades, underscore the vital role of seasonality in shaping its market movements. As we delve into the intricate dance of supply, demand, and cultural influences that define gold’s seasonality, the autumn of 2025 emerges as a period rich with potential for both gold and its stocks. The synergy of historical patterns, current trends, and future prospects presents an intriguing landscape for investors, promising a season of vibrant activity and, potentially, rewarding gains in the gold market.