Silver’s Recent Surge: A Detailed Analysis

Over the past few weeks, the silver market has witnessed a notable ascent, enhancing its value by 7.40% since the 10th of July. This upward trajectory has piqued interest among investors and market analysts alike, prompting a closer examination of silver’s performance through various analytical lenses.

Retrospective Glance

To grasp the current momentum fully, it’s pivotal to delve into the historical context of silver’s market behaviour. Silver, a metal revered for both its industrial and precious qualities, has seen its share of peaks and valleys. By scrutinizing its past and current market dynamics, one can better understand the forces at play.

Weekly Market Movements

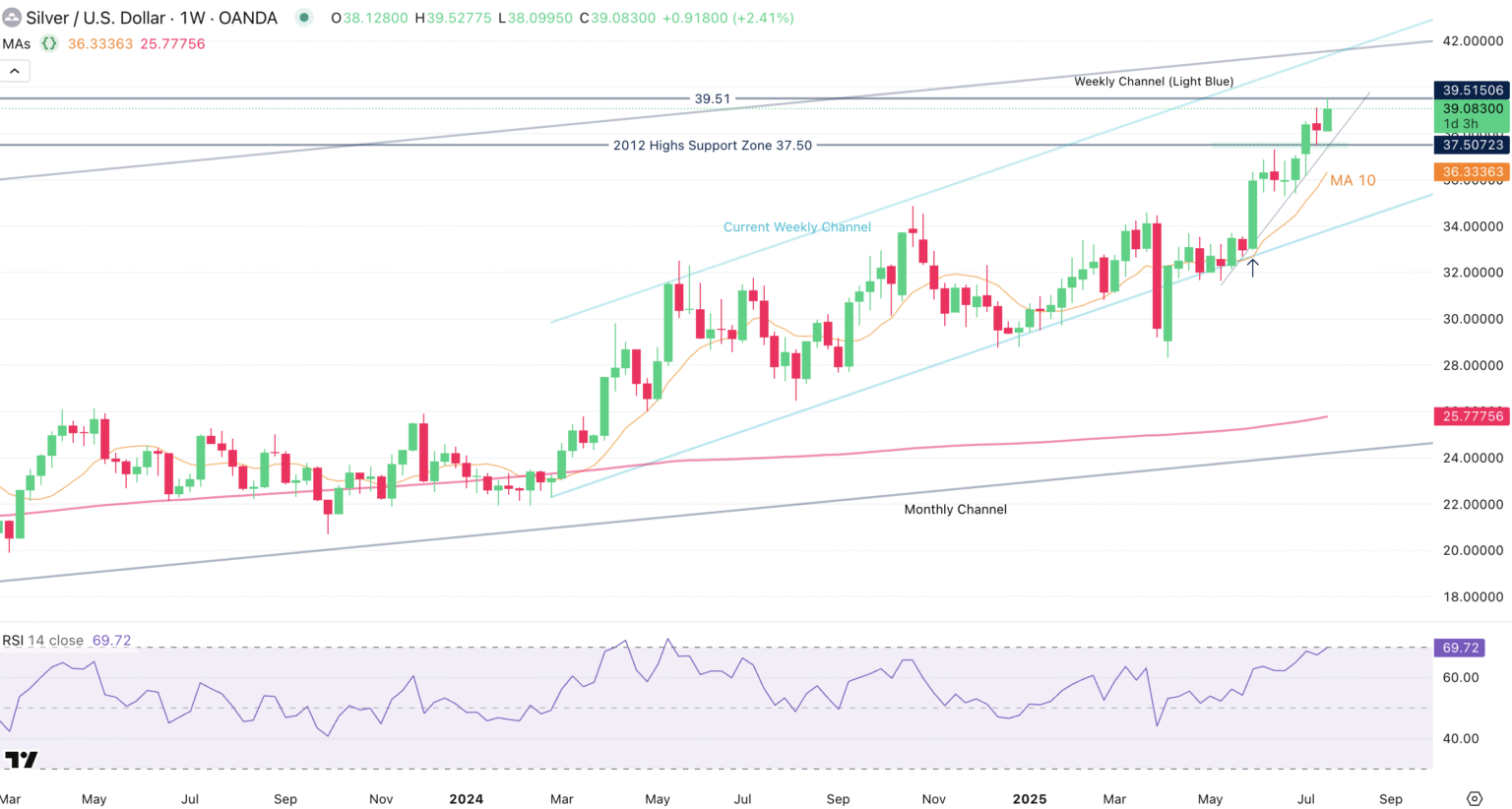

A glance at the weekly chart reveals a burgeoning momentum, albeit one that is brushing against the upper limits of the Relative Strength Index (RSI), signaling an approach towards the zenith of the current bullish channel. This channel, delineated in light blue, showcases a prospective $2 to $3 increment needed to reach the pinnacle of this thriving phase. Such graphical representations are vital for investors, affording them a macroscopic view of silver’s market disposition.

Daily Dynamics

Zooming into the daily chart, silver’s assertive leap towards the $39 to $39.50 resistance mark becomes evident, a threshold highlighted in last week’s forecast. Despite this vigorous climb, reaching the weekly channel’s upper bounds remains a Herculean task, compounded by the metal’s present overbought state. The 20-day Moving Average (MA) is gradually aligning with current prices, now stationed at $37.50, suggesting a potential recalibration of momentum towards equilibrium. Historical patterns indicate that following a reattachment of price to the 20-day MA post momentum neutralization, silver typically undergoes consolidation or minor pullbacks along its upward trajectory.

Hourly Insights

An inspection of the 4-hour chart indicates a simmering potential for an upward breakout, conditional upon a robust surge backed by substantial volume and a daily closure surpassing the $39.51 zenith of previous highs. In the event of a downturn, it’s plausible that the consolidation could stabilize between $37.50 (the 2012 support level) and $39.50 (the current resistance), especially as these levels resonate with the upward trendline established in May.

Critical Levels to Watch

For those monitoring the market’s pulse, noteworthy support and resistance levels exist. Immediate intraday support lingers at 146.37, with an additional pivot zone around 146.00 (+/- 100 pips) and main daily support in the 142.00 region. Conversely, resistance is found at the $39 to $39.5 bracket, with potential challenges at $39.51 (last swing highs) and an anticipated resistance between $40.50 to $41, marking all-time highs and the top of the rising channel.

Historical Parallels

Casting a gaze back to 2011 offers intriguing insights, as silver once again approaches price levels reminiscent of past glories. This historical lens could provide valuable foresight for anticipating market reactions, should silver replicate or surpass these former milestones.

Comparative Metal Performances

Since May 2025, an examination of the most traded metals illustrates a formidable ascent akin to the period between 2008 and 2011. An endless appetite for higher deficits, barring unforeseen rate hikes, suggests a sustained bullish run for metals, with silver prominently positioned within this narrative.

Concluding Remarks

Silver’s market journey is a testament to its enduring allure and economic significance. As investors navigate this volatile landscape, informed analysis and historical context become invaluable tools in predicting future movements. Whether the current uptrend will maintain its momentum remains to be seen. However, the intricate dance between support and resistance levels, coupled with macroeconomic factors, paints a riveting picture of silver’s potential trajectories.

Safe Trades!

This analysis is adapted from insights shared by market experts, aiming to provide a comprehensive perspective on silver’s market dynamics. For the original analysis and more, visit Here.