In the ever-evolving landscape of global finance and trade, the anticipation surrounding the transatlantic trade agreement between the European Union and the United States had been building up. Market insiders and observers alike had been closely monitoring developments, fully expecting a deal to materialize soon. Their patience was rewarded as the announcement came through that the EU-US Trade Deal is on the verge of being finalized. Though what we have at the moment is merely a framework of the agreement awaiting formal ratification, it is a significant indicator that for all intents and purposes, the agreement is in place.

The news of this pending agreement has sent ripples through financial markets, impacting currencies and equities in various ways. Notably, the US dollar has experienced a surge in strength, particularly noticeable against the Euro. This uptick comes in the wake of what appears to be a double-top formation, suggesting potential implications for currency traders and international markets.

On the equities front, reactions have been mixed. Some segments of the market have retreated post-announcement, highlighted by the sell-off in specific sectors. This diverse response underscores the complexity of market dynamics in the wake of significant geopolitical developments and their far-reaching implications across different asset classes.

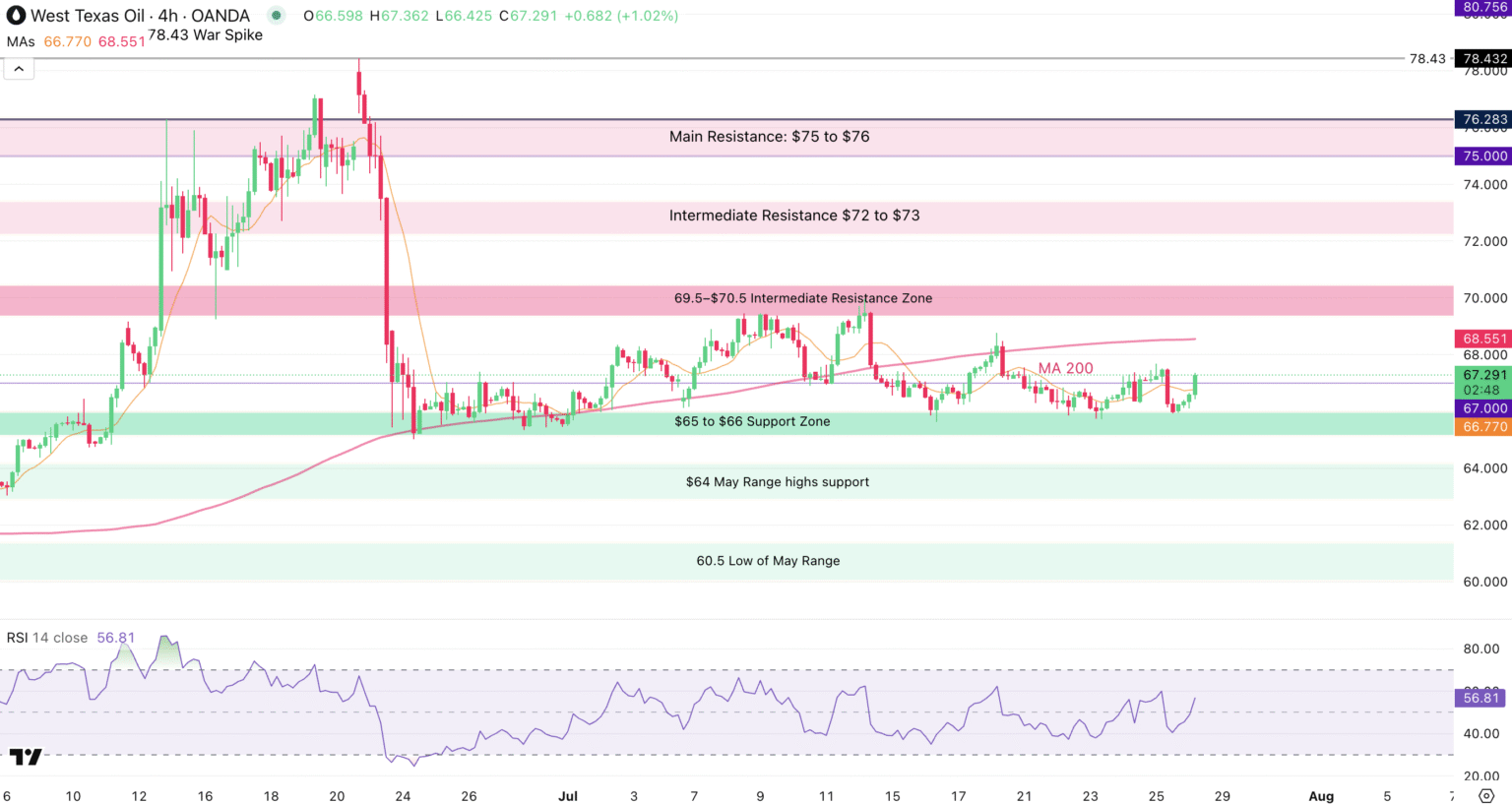

A focal point of interest in the aftermath of this announcement has been the oil market, which, despite the geopolitical fluctuations, continues to trade within its established range. However, recent buying activity indicates a potential shift, stirring speculation about an imminent breakout.

Delving into a detailed analysis, let’s examine the technical landscape that underpins the oil market’s current state. In today’s discussion, we’ll forgo the daily charts and concentrate on the intraday movements that provide insight into immediate trends.

The recent range-bound activity in US oil prices deserves scrutiny. Despite two attempts to breach the $70 barrier, oil prices have tightened, fluctuating between $65.5 and $67. This pattern of trading within a defined range is indicative of a balance of power between buyers and sellers, waiting for a catalyst to tip the scale in either direction.

Historically, traders are often tempted to predict reversals in trends prematurely. However, the lesson here is the importance of patience and awaiting confirmation before making decisive moves.

Zooming in on the more granular 1-hour chart, there’s significant buying momentum with oil prices climbing close to 3% since the start of trading on Sunday. Despite the market being overbought, the strength of the buying suggests that consolidation at current levels is more likely than a retreat to the lower end of the range. The breach above the key pivot of $67.50 serves as a critical point of interest for traders monitoring the range-bound dynamics.

Further examination through a 15-minute chart reveals that the buying wave is maintaining its momentum, successfully holding above the previously identified pivot zone of $65.45 to $65.70. This indicates a higher probability of testing the range’s upper bounds, with an eye on an intermediate resistance level that emerged in early July trading near $68.50.

In concluding this analysis, it’s pertinent for traders to approach the market with caution and strategize their moves based on confirmed trends rather than speculation. As always, wishing everyone safe trades and a successful week ahead.

This ongoing development in the EU-US Trade Deal and its resultant effects on global markets including the oil market offers a fascinating insight into the interconnected nature of geopolitics, finance, and commodity trading. The intricate dance of negotiations leading up to this almost-finalized agreement serves as a striking example of how diplomatic and trade relationships sculpt the global financial landscape, influencing not just markets but the broader economic outlook across continents.