In a move that has sent ripples through international trade discussions, the President of the United States, Donald Trump, issued a stark warning on the 14th of July. He stated that unless a peace agreement between Russia and Ukraine was reached within the next 50 days, substantial secondary tariffs would be levied on the trading partners of Russia. This announcement has raised eyebrows across the globe for several reasons, not least because of the ramifications it could have on international trade dynamics.

Central to Trump’s warning is the implied threat towards China, Russia’s most significant trading ally. The imposition of high tariffs on US imports from China would not only strain Sino-American relations further but would also potentially disrupt the global supply chain. Given the low likelihood of a peace agreement being brokered between Russia and Ukraine within the stipulated timeframe, along with China’s negligible probability of ceasing trade relations with Russia in response to US threats, the situation appears to be steering towards a critical juncture. Trump now faces the dilemma of either implementing his threatened tariffs against China or retracting his statement.

This scenario is not without precedent. Recent months have seen the Trump administration engage in similar tactics, resulting in a bilateral imposition of higher tariffs between the US and China. One significant consequence of this trade altercation was China’s retaliatory action of halting exports to the US of Rare Earth Elements (REEs) and other crucial metals. The repercussions of this were immediately felt across several key industries in the US, notably in automotive, battery manufacturing, turbine production, and military equipment sectors, almost bringing them to a halt. It led to the US government urgently negotiating a deal that saw a rollback of some tariffs.

The crux of this economic confrontation lies with China’s command over the global supply of REEs. These elements are essential for the functioning of a modern economy, playing a pivotal role in the development of high-tech devices and renewable energy technologies. The significance of REEs will only grow as technology continues to advance, thereby reinforcing the strategic importance of REE supply chains. Over the past five years, this looming reality has garnered increased attention, emphasizing the necessity for diversification of REE sources and the potential value appreciation of mines and processing facilities located outside of China.

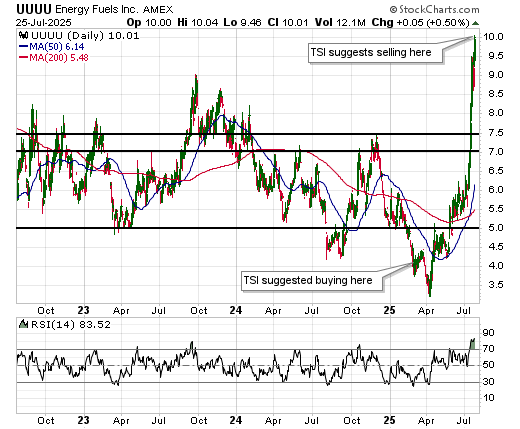

An unintended outcome of the ongoing trade skirmishes has been the spotlight shining on the vulnerabilities imposed by China’s dominance over REE supplies. This revelation has triggered a reaction within the stock market, with investors rapidly recalibrating the valuations of companies that are poised to benefit from diversification efforts in REE sourcing. For instance, the stock prices of companies like Energy Fuels and Neo Performance Materials have more than doubled, reflecting the market’s acute awareness of the strategic importance of REEs.

However, despite these tumultuous market movements, the actual prices of the underlying REE commodities have not experienced the same dramatic fluctuations. Neodymium, a widely utilized REE, despite witnessing a steady price increase since March 2024, is yet to reach the price peaks observed between 2021 and 2023. This trend suggests that while the stock market anticipates a significant shift, the commodities market has yet to fully respond to the underlying supply and demand dynamics.

This situation suggests we are at a pivotal moment, akin to mid-2020, when global economies and markets were grappling with unprecedented challenges. The potential for rapid acceleration in REE prices is real, as countries and companies around the world scramble to secure their supplies against a backdrop of geopolitical tensions and trade uncertainties.

In essence, the warning issued by President Trump underscores a complex web of international relations, trade dependencies, and strategic commodities that are integral to the functioning of the global economy. As we navigate through these turbulent times, the decisions made today will undoubtedly have long-lasting impacts, shaping the future of international trade, economic policies, and technological advancements.