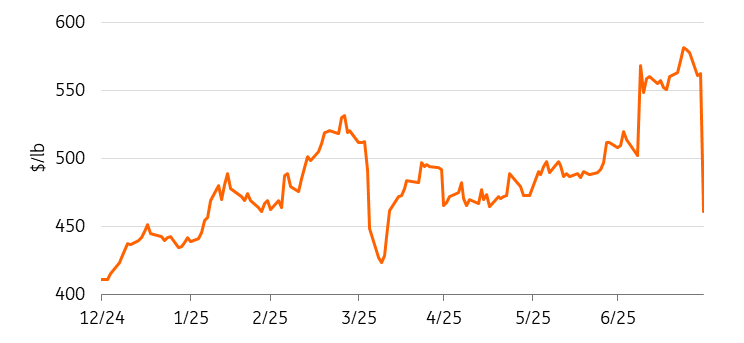

In the world of commodities trading, moments can bear witness to dramatic shifts, exemplifying the intricate dance between policy decisions and market reactions. A vivid instance of this unfolded when the price of copper on the Commodity Exchange (Comex), experienced a precipitous drop, declining more than 19% in a matter of minutes. This significant event occurred in the wake of an announcement by then-President Donald Trump, that refined copper would be exempted from his proposed import tariffs. The rapid fall in copper prices on that Wednesday marked the most substantial intra-day decrease in the commodity’s history, though there was a subsequent partial recovery in prices.

At the heart of this narrative is the influence of governmental policy on global commodities markets, a theme that has repeatedly played out with various administrations and their economic directives. Trump’s administration, known for its aggressive stance on trade, had indicated a plan to impose a 50% tariff on imports of semi-finished copper products. These products encompass a range of goods including copper pipes, wires, rods, sheets, tubes, and copper-heavy items such as pipe fittings, cables, connectors, and electrical components, set to start from the 1st of August. Notably, the tariffs would not apply to imports of copper ore, concentrates, mattes, cathodes, and anodes.

Before this announcement, anticipation of these tariffs had led to copper prices in the US trading at a premium of 28% above the prices on the London Metal Exchange (LME), as the market anticipated the new policy. Post-announcement, analysts predicted a significant decline in the Comex-LME premium.

Adding to the complexity of the situation, Trump’s initial allusions to imposing a tariff on copper imports back in January had sparked a surge in shipments of the metal to American ports. From January to May, US refined copper imports soared by almost 130% year-over-year, swelling copper inventories at Comex warehouses to their highest levels in 21 years. This glut of copper inventory in the US seemed poised for re-export, a move likely to depress prices further on the LME as more copper entered its warehouses.

The copper tariff plan, part of Section 232 of the Trade Expansion Act, was distinct from and would not be additive with the previous tariffs on automobile imports imposed earlier in the year. In cases where products were subject to auto tariffs, only the import tax on vehicles would be applied, excluding the copper duty.

In a strategic move, Trump also leveraged the Defense Production Act—a law that grants the president authority to direct industry production in areas critical to national security—to stipulate that 25% of high-quality copper scrap and raw copper produced in the US must be sold domestically. This requirement is set to increase in the coming years, reaching 40% by 2029.

While the fluctuations in copper prices can be attributed to immediate market reactions to policy announcements, they also reflect deeper dynamics at play. Prices had been climbing throughout the year, spurred not by genuine shifts in demand or constrictions in supply, but largely by market speculation around the impending tariff policy.

This incident underscores the intricate relationship between political policy and commodity markets, where decisions made by governments can have immediate and profound impacts on global trade flows, industry practices, and market sentiments. As traders and analysts look beyond the immediate tumult caused by tariff announcements, deeper analyses into the underlying fundamentals of supply, demand, and geopolitical shifts will continue to guide expectations and strategies in the ever-volatile commodities markets.

The implementation and implications of trade policies such as these illustrate the balancing act nations perform in protecting domestic industries while engaging globally. The ripple effects of such tariffs create narratives of adaptation and strategy, as market participants reassess and recalibrate in the face of new challenges and opportunities.