Gold Stocks: A Comprehensive Analysis of Their Surging Performance and Bright Future

In the financial realm, certain investment opportunities periodically come to the forefront, capturing the attention of traders and investors alike due to their remarkable performance. Recently, the gold sector has exemplified this phenomenon. Often overlooked, gold stocks have experienced a phenomenal summer, demonstrating strength by consolidating near significant secular highs. These developments have imbued the GDX gold-stock ETF—a leading benchmark for the sector—with quite a bullish outlook as it heads into its traditionally strong season.

Understanding the Mechanics of Technical Analysis

To decode the movements in gold stocks, it’s imperative to comprehend technical analysis, the discipline serving as the basis for these assessments. At its core, technical analysis examines historical price data to forecast future price trends. This methodology hinges on the premise that prices, influenced by the collective decisions of all traders, encapsulate all pertinent information. By tracking price trends over time, technical analysis reveals opportune moments for entering and exiting trades. The rationale behind its effectiveness lies in the widespread practice among traders of consulting price charts prior to executing buy or sell orders.

The GDX VanEck Gold Miners ETF: A Sector Benchmark

Since its inception in mid-May 2006, the GDX VanEck Gold Miners ETF has ascended to become the gold sector’s most esteemed benchmark. As of mid-2025, its net assets have burgeoned to $15.2 billion, dwarfing those of its nearest rival. Dominated by major gold miners, this ETF is pivotal in gauging the sector’s performance, serving as an indispensable resource for traders seeking insight into market trends.

A Stellar Performance in 2025

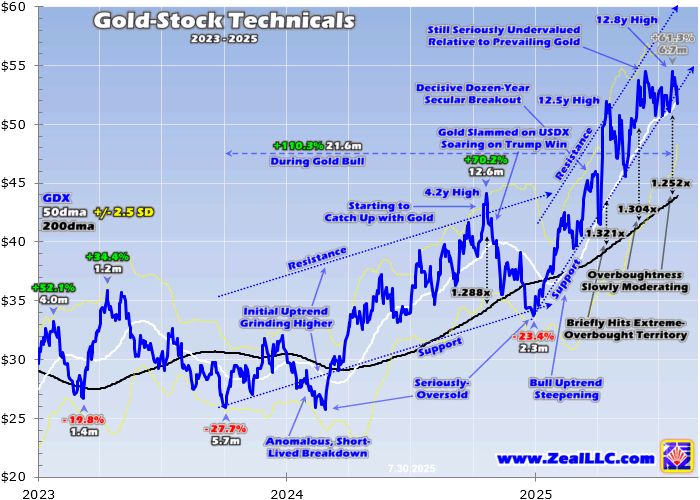

The year 2025 has witnessed a meteoric rise in GDX, with gains of 52.7% year-to-date, capping off a 110.3% bull run that commenced in early October 2023 and persisted until late July 2025. These impressive gains in gold stocks have been propelled by a robust cyclical bull market in gold, which itself surged by 88.6% at its peak in mid-June 2025, remarkably without enduring any correction exceeding 10%. Despite these gains, it’s noteworthy that gold stocks have underperformed relative to the metal itself, a discrepancy signaling potential for a significant catch-up rally, as suggested by GDX’s bullish technical indicators.

Technical Indicators and Future Prospects

An analysis of GDX’s technical indicators over the past few years showcases a strong, steep uptrend. Notable achievements include multiple secular highs achieved without veering into excessively overbought territory. The resilience of key moving averages as support further reinforces the bullish sentiment surrounding gold stocks.

Phases of the Bull Run

The bull run of GDX is characterized by two distinct phases. The first, spanning from early October 2023 to late December 2024, while modest, saw a significant surge. The noteworthy strength of gold stocks during this period, culminating in a 4.2-year secular high in late October 2024, serves as a testament to their robustness. Despite a subsequent market correction induced by geopolitical events and the resultant gold futures selling, gold stocks swiftly rebounded, embarking on a steeper rally phase. This resurgence was marked by major technical milestones, including a ‘Golden Cross’ buy signal in mid-February 2025, further cementing the bullish outlook for gold stocks.

The Role of Fundamentals in Supporting the Bullish Technicals

While technical analysis provides valuable insights, a comprehensive assessment of an investment opportunity necessitates consideration of underlying fundamentals. The gold mining sector’s recent quarterly results have been exceptionally strong, indicative of the sector’s health and potential for sustained growth. This period of record earnings, primarily driven by high gold prices, underscores the efficiency of gold miners in leveraging the precious metal’s bull run. As the sector continues to report outstanding financial results, it increasingly attracts professional fund investors, contributing to a virtuous cycle of investment and growth.

Looking Forward: The Intriguing Potential of Gold Stocks

As we delve deeper into 2025, the outlook for gold stocks remains remarkably optimistic. With technical indicators signaling strength and fundamentals supporting sustained growth, the sector is poised for its next major breakout. This anticipated surge is not only underpinned by historical patterns of seasonal strength but also by current dynamics, such as unprecedented earnings growth among gold miners.

In summary, gold stocks stand at the precipice of a potentially transformative period. Bolstered by strong technicals and unparalleled fundamentals, the sector is on the cusp of realizing its full potential. For investors and traders alike, the current juncture offers a compelling opportunity to participate in what may very well be a golden era for gold stocks.