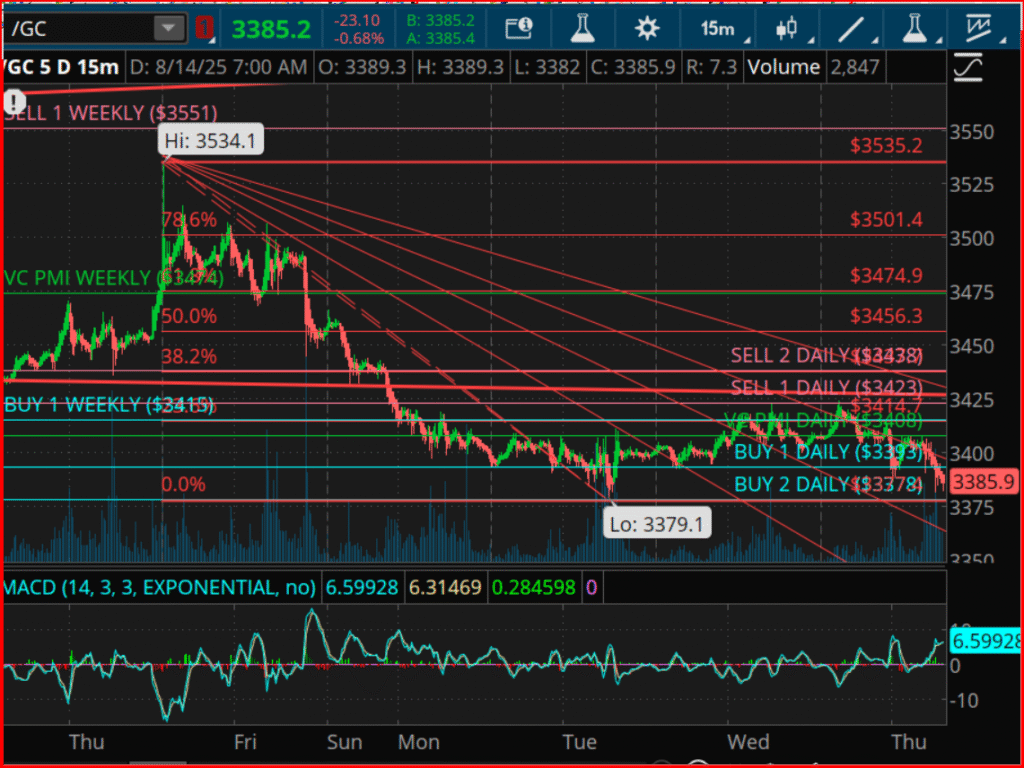

The marketplace is edging towards a pivotal juncture that could redefine trading strategies in the near future. This shift is underpinned by a confluence of time cycles, price harmonics, and levels of mean reversion, coming together to create a window of opportunity for high-probability trading. In recent actions, there was a noticeable descent from the peak on August 7, where the price hit $3,534.1, descending into a pattern of consolidation within the $3,378–$3,393 bracket. This specific range is significant as it aligns with key industry-standard trading markers: the Buy 1 and Buy 2 Daily VC PMI levels, and importantly, the 0% Fibonacci retracement point from the latest downward movement. These indicators collectively suggest that this zone could potentially act as a reversal point.

An interesting angle to this narrative comes from utilizing the principles of Gann time cycle theory. According to this theory, the current period marks a critical 45° rotation from the August 7 high—a landmark period that historically signals a high likelihood of a reversal. William Delbert Gann, the mind behind this theory, posited that the financial markets move in predictable cycles, and a 45° time division often serves as a harbinger for a significant market shift, either as a countertrend move or a continuation rally, contingent on the prevailing market conditions. In the current context, with the market probing the lower bounds of its mean reversion boundary, there’s an augmented chance that an upward market correction might be on the horizon.

Further depth is added to this analysis through the application of Square of 9 principles, another technique attributed to Gann. By anchoring at the $3,379 low, projections can be made for potential upward targets at $3,423, $3,456, $3,501, and $3,551. Remarkably, these projections correspond closely with VC PMI Sell 1 levels, Fibonacci retracement points, and weekly resistance territories, underscoring their relevance as checkpoints for any emerging upward market movement.

At this moment in time, market sentiment, as per daily and weekly pivot levels determined by the VC PMI methodology, continues to skew towards the bearish below $3,408 and $3,474 respectively. This indicates that any departure from current levels would initially be viewed as a countertrend move within the overarching bearish framework, with the possibility of a bullish transition should these pivotal levels be overtaken and sustained.

Should the market maintain its position above the $3,378 marker during this key 45° Gann time pivot, a robust argument can be made for a bullish rebound, potentially extending to $3,408, and then possibly further to the $3,423–$3,438 region. The forthcoming 90° rotation, slated for August 17–18, may then serve as the launchpad for an intensified push towards $3,474 or beyond. Conversely, a fall below $3,378 would suggest the dominance of bearish forces, possibly driving prices down to $3,356 or lower before the emergence of a new cycle window.

To put it succinctly, gold finds itself at a pivotal crossroads. The ensuing 24–48 hours are poised to dictate whether this interval will form the foundation of a market reversal or mark the commencement of a more pronounced correction. The intricate blend of time cycle symmetry, harmonic price targets, and mean reversion levels as presented by the VC PMI framework heralds a juncture of heightened interest that warrants meticulous attention.

It’s paramount to bear in mind that trading in derivatives, financial instruments, and precious metals carries a substantial risk of loss and may not be suitable for all investors. Historical performance, while a valuable indicator, does not necessarily predict future outcomes.

This unfolding scenario is not just a testimony to the intricate dance of market forces but also serves as a poignant reminder of the perpetual struggle between bearish and bullish sentiments, each vying for dominance. As traders and investors stand by, watching this unique convergence of elements, the days ahead promise to be rich in activity, potentially laying the groundwork for significant market moves. Whether this period will be looked back upon as a turning point or simply another chapter in the ongoing saga of market fluctuations remains to be seen.