In recent times, the global economic landscape has been rife with uncertainty, and among the myriad factors influencing market sentiments, the price of gold has remained a focal point for investors. As of this Tuesday, the gold market appeared to stabilize, with prices hovering around USD 3,330 per troy ounce. This period of equilibrium comes as investors digest the implications of US-led diplomatic initiatives and await crucial insights from the Federal Reserve’s annual symposium in Jackson Hole, Wyoming.

The backdrop to this financial narrative began earlier, notably after a pivotal meeting at the White House on Monday. The President of the United States, Donald Trump, revealed that discussions with Russia had taken place and further disclosed his initiative towards facilitating direct negotiations with the leaders of three other nations. This move has been interpreted as a concerted effort towards brokering peace, injecting a cautious optimism into the market. Nonetheless, investors remain wary, fully aware that such geopolitical maneuvers are complex and unlikely to yield immediate resolutions.

Attention within the financial community is also keenly turned towards the impending address by Jerome Powell, the Chairman of the Federal Reserve, at the symposium in Wyoming. Market participants are on edge, seeking any indications of a shift in monetary policy, specifically the possibility of interest rate cuts in September. The consensus, for now, remains anticipatory of a rate reduction at the Fed’s September meeting, potentially followed by a modest easing towards the end of the year, not exceeding 25 basis points.

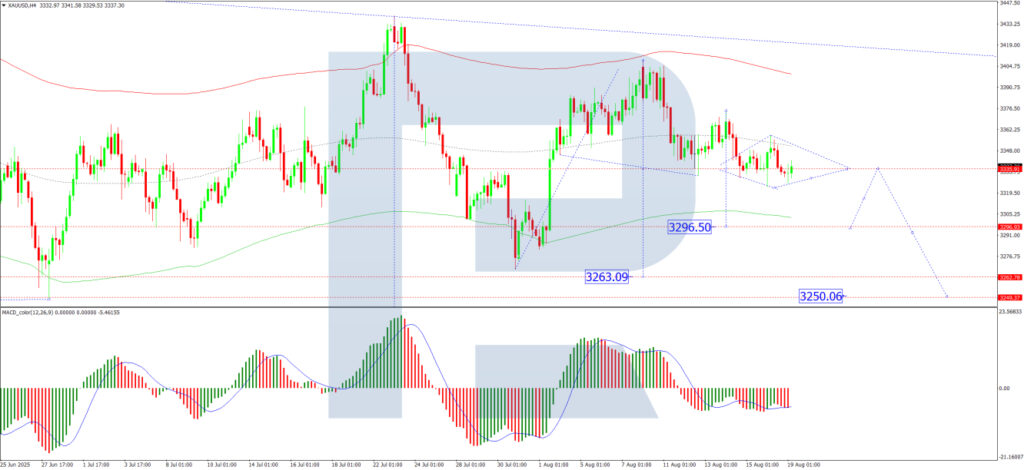

In the realm of technical analysis, the situation presents a nuanced picture. Focusing on the four-hour chart for XAU/USD (gold priced in US dollars), it is apparent that the market is navigating through a broad consolidation phase, centralized around the 3,333 level. The trend has demonstrated a capacity for both upward and downward extension, suggesting a dynamic and uncertain environment. Currently, a downward trajectory towards 3,296 seems plausible, with the possibility of a corrective rally back to 3,333 before a further dip to 3,263. The anticipated formation of a lower wave aiming for 3,250 is technically corroborated by the MACD indicator, wherein the signal line is positioned below zero and oriented downwards, signifying bearish momentum.

A closer examination of the hourly chart for XAU/USD reveals that after achieving a decline to 3,333, the price entered a consolidation period around this level. The unfolding third wave of descent aims for 3,297, with a potential continuation towards 3,260. This setup is further validated by the Stochastic oscillator, with its signal line nearing the 80 mark and poised to descend towards 20, highlighting increasing bearish pressure.

To summarize, the gold markets are presently navigating through a landscape shaped by geopolitical tensions and anticipatory sentiment regarding monetary policy decisions from the Federal Reserve. Despite the stabilizing prices above USD 3,330, technical analyses advocate the scenario of a downward trend with pivotal targets set at 3,296, 3,263, and possibly extending to 3,250. Amidst these fluctuations, a short-term consolidation remains in the vicinity of 3,333.

This unfolding situation embodies the intricate interplay between geopolitics, economic policy decisions, and market dynamics. As these factors continue to evolve, they underscore the complexity of predicting market behavior and the importance of vigilance in investment strategy formulation.

Disclaimer: This analysis is the product of synthesizing various data points and represents the author’s perspective. It is not intended as investment advice. The financial outcomes of trading decisions based on this analysis are not the responsibility of the author or RoboForex Analytical Department. Traders are urged to conduct their due diligence before engaging in market activities.